Foreclosure is a nightmare to any family going through it irrespective of the reasons why they are about to lose their home. Today we are going to look at the foreclosures effects in CARLISLE OH and what local house sellers need to know. First we will look at the effects and the ways of easing them.

Foreclosure is a nightmare to any family going through it irrespective of the reasons why they are about to lose their home. Today we are going to look at the foreclosures effects in CARLISLE OH and what local house sellers need to know. First we will look at the effects and the ways of easing them.

Foreclosure Effects in CARLISLE OH to Sellers

- Loss of your home – Pretty self-explanatory here. The major end result of a foreclosure in OH is of course the loss of the home to the bank.

- Decrease in Your Credit Rating – Your credit rating will be lowered by the foreclosure. How much? It depends on how high your current credit score is… but the higher your current credit score… the more your score will drop after a foreclosure. If you have a credit score of 680 or higher… you may see a drop of 100+ points.

- Depression and Stress – Your mental health is at stake because of the high pressure situation. Going through a foreclosure is emotionally exhausting and frustrating to say the least.

- House Values In Your Community – Another one of the big foreclosure effects in CARLISLE OH is that they tend to lower the overall value of the houses in your neighborhood… especially if there are multiple foreclosures in the immediate area.

How You Can Ease The Effects Of Foreclosure In CARLISLE

For the well being of you and your family, you need to mitigate the effects of foreclosure as much as you can. The process can be frustrating and time consuming, but there are people who can help you navigate your different options in the process.

First…

- Call your bank and work with them: Most banks are very willing and ready to work with you… if you can show that with their help you can get back on track and save your house. Or, if you just want out of the house but you owe more on the house than it’s worth… see if the bank has any programs to lower the mortgage burden so you can get out from underneath it without it going through an expensive foreclosure.

- Talk with a local real estate expert, like Rae Buys Houses: We know the local CARLISLE real estate market well and are very experienced in the foreclosure process here in OH. Give us a call at 937-557-1802 and we can guide you toward the resources that can possibly help you.

- Sell your house: If you’d rather find a way to sell your house and avoid the foreclosure all together, great! We buy local CARLISLE houses for cash… and would love to look at your situation and make you a fair all-cash offer on your house. Just call us at 937-557-1802 or shoot us your details through this website.

With the above knowledge on foreclosure effects in CARLISLE – what sellers need to know, you can guard yourself by calling Rae Buys Houses at 937-557-1802 and we shall assist you in the shortest time possible to sell your house. However, to fast track the process, kindly fill out our website contact form to give us more information about you. We’d love to connect with you and help you find the best solution!

How Long Does Foreclosure Affect Your Credit?

Once a home is lost to foreclosure, the homeowner’s credit score could drop dramatically. According to FICO, for borrowers with a good credit score, a foreclosure can drop your score by 100 points or more. If your credit score is excellent, a foreclosure could reduce your score by as much as 160 points. In other words, the higher your credit score the more impact a foreclosure will have.

Typically, it will take three years or more of on-time payments to restore the credit score. If the foreclosure is an isolated event and the borrower’s credit is otherwise sound, consumers may be able to recover more quickly. It can take anywhere from three to seven years to fully recover.

A low credit score due to foreclosure can result in expensive interest rates and limited credit, making financial recovery difficult.

When Will a Foreclosure Start Impacting Your Credit?

Your mortgage lender will typically report any payment that is 30 days later or more to the credit bureaus. This means that before the foreclosure process ever begins, your credit will be negatively impacted by each late payment. Most banks wait at least 90 days after failure to make payment to begin foreclosure proceedings. The process can often take several months or more to be completed. It is realistic that if you have not made payments, by the time a foreclosure is completed, your credit score could be reflecting at least six months of missed payments. This can have a significant impact on your credit.

How Is Your Credit Score Calculated?

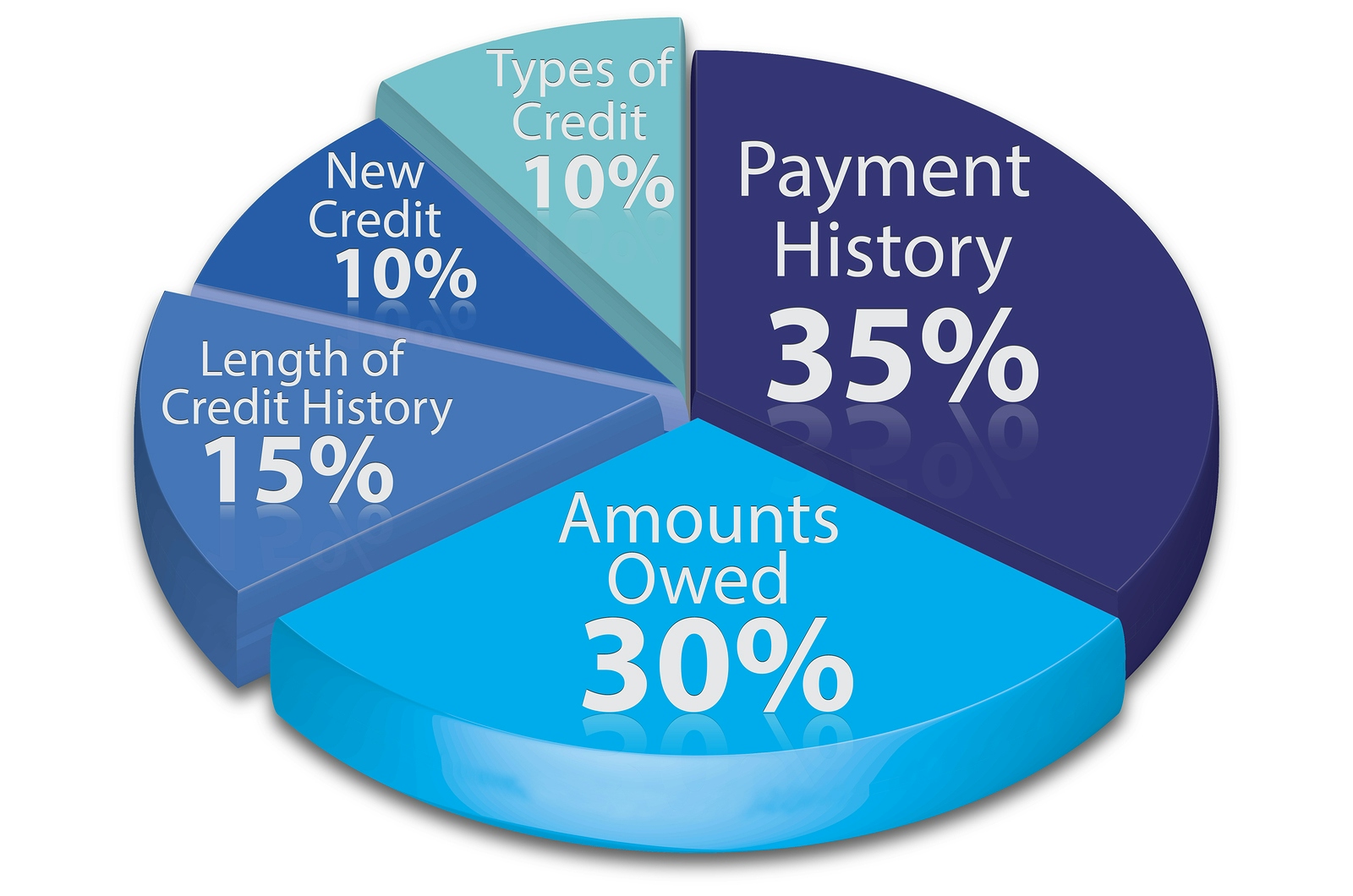

The components of a FICO score consist of payment history, amounts owed, length of credit history, new credit, and types of credit used.

Foreclosure Tax Consequences

While it’s common to hear about the credit consequences of foreclosure, not everyone considers the tax consequences. A foreclosure brings about a property title transfer and subsequent tax assessment. Most property owners do not realize that by losing their home to foreclosure, there are likely going to be tax implications.

Any time debt is forgiven; it is considered a taxable event. The IRS states that any borrowed money that is not paid back is considered as income and is taxable. A mortgage involves the bank or lender granting funds to the owner in return for a promise to pay the funds back. When the owner begins repaying the money, this money is not claimed as income on their tax return. If, however, this debt amount is canceled or forgiven, it will have to be included as income for tax purposes. The loan amount is considered income because there is no longer an obligation to repay the lender for the same.

Once the property is sold by the lender, the tax consequences come in. The original loan was based on the value of the property, but these values keep changing. If the property is sold for less than it was originally worth, and the bank is unable to recover all the money it had lent, the balance is reported to the property owner and the IRS on a Form 1099-C, Cancellation of Debt. This amount is considered as income and must be reported on the homeowner’s income tax form leading to capital gains and income tax applicable.

Typically, the only instance where such income is not taxable is when debts are discharged through bankruptcy. Canceled debt tax may apply if the homeowner is labeled insolvent or with reference to certain farm debts and non-recourse loans. It’s always the wisest and safest course of action to consult a tax professional to advise on your specific situation and what you can expect.

Buying Another Home After Foreclosure

It is common, following a foreclosure, for the borrower to seek a future mortgage. While it might take some time and effort, it is certainly not impossible to purchase a home following a foreclosure. To qualify for a future mortgage loan, most lenders will require a credit score above 620. Most lenders will also require a waiting period before they would consider a loan application.

If there are documented extenuating circumstances, they could have a direct bearing on the number of years to wait to get a conventional loan.

One of the best options for obtaining a mortgage after foreclosure is with a federally insured FHA loan. Three years is the minimum time required between the completions of foreclosure until approval of an FHA loan, regardless of any extenuating circumstances. FHA borrowers still have to prove good bill-paying habits since the foreclosure for any approval as well.